Blog

This blogs purpose is to provide personal everyday stories to about the five tenets of what we believe are the foundation building blocks of a successful life. These being Family, Health, Leisure, Business and Money. We hope you enjoy our stories.

Fund Manager Friday – Episode 14 – Luke Deland – Pengana Capital Group

Luke discusses the asset class – global private credit. Global private credit is a form of alternative investment that involves lending money to private companies/individuals, typically through non-bank lenders/intermediaries. Unlike public debt, which is traded on open markets, private debt is usually negotiated and structured directly between the borrower and the lender, with less regulation […]

Fund Manager Friday – Episode 13 – Stephen Walker – BT

Wrap Accounts are a flexible and convenient Investment Option. Stephen explains that this type of investment account allows investors to access a range of managed funds, shares, and other assets through a single platform. Investors pay a single fee for the administration, reporting, and advice services provided by the wrap account provider. As you know, […]

Fund Manager Friday – Episode 12 – William Orr – Ausbil

William explains the Ausbil Small Cap Fund and its role in the portfolio, and the huge potential of this neglected sector. A small-cap fund is a type of investment fund that focuses on companies with relatively small market capitalisation. These companies are often considered to have higher growth potential and lower valuation than larger companies, […]

Fund Manager Friday – Episode 11 – Jennifer Lyon – Metrics

Jennifer explains the Metrics Direct Income Fund, a managed fund that aims to provide investors with consistent and attractive monthly income from the Australian corporate loan market. The fund invests in a diversified portfolio of senior secured loans and bonds issued by Australian and New Zealand companies, as well as some global issuers. As you […]

Fund Manager Friday – Episode 10 – Michael Lagudi Perpetual Asset Management

Michael explains how Perpetual advocates for its unit holders by engaging with company boards and management on various issues, such as strategy, capital allocation, governance, remuneration, and environmental, social, and governance (ESG) factors. One of the key vehicles for Perpetual Limited’s active engagement is its Strategic Capital Fund, which is a fund that invests in […]

Fund Manager Friday – Episode 9 – Amy Xie Patrick Pendal

Amy Xie Patrick explains how to manage fixed income portfolios to provide a regular income stream with superior returns to cash. As you know, we are always looking for ways to help you make informed decisions and achieve your goals. That’s why we have been talking to some of the best fund managers and product […]

Fund Manager Friday – Episode 8 – Marjon Crandall Perennial Partners

Perennial’s private to public fund is a type of investment fund that aims to provide long-term capital growth by investing in private companies that have the potential to go public in the future. The fund seeks to identify and partner with innovative and disruptive businesses that can benefit from the fund’s expertise and network in […]

Fund Manager Friday – Episode 7 – Daniel Connell – Schroders Real Return Fund

Daniel explains how the Schroders Real Return Fund aims to provide investors with a consistent and stable return above inflation over the medium to long term. He speaks about the fund investing in a range of asset classes, including equities, fixed income, cash, commodities, and alternative strategies, and dynamically adjusts its exposure to suit the […]

Fund Manager Friday – Episode 6 – Daniel Connell Schroders

Daniel explains how a private equity fund generates superior returns for its investors by creating value in its portfolio companies. As you know, we are always looking for ways to help you make informed decisions and achieve your goals. That’s why we have been talking to some of the best fund managers and product providers […]

Fund Manager Friday – Episode 5 – James Spiridon Challenger Limited

James describes how a guaranteed income stream can provide a regular payment for life or a fixed term, regardless of market fluctuations or interest rates. It can be a valuable component of a client’s retirement portfolio, as it can help them to: • Reduce the risk of outliving their savings • Protect their income from […]

Fund Manager Friday – Episode 4 – Alex Dalla Fontana Vanguard

Index funds are a type of investment that aims to track the performance of a market index, such as the S&P 500 or the ASX 200. They are popular among investors who want to diversify their portfolio, lower their costs, and reduce their risk. But what exactly are index funds and how do they work? […]

Fund Manager Friday – Episode 3 – Dr Don Hamson Plato Investment Management

The Plato Investment Management Australian Income Fund (the Fund) is a managed fund that aims to provide investors with a high level of income from Australian shares, with a focus on franked dividends. The Fund is managed by Plato Investment Management Limited (Plato), a boutique investment manager that specialises in income-oriented strategies. As you know, […]

Fund Manager Friday – Episode 2 – Allianz Retire+

Justine Marquet from Allianz Retire+ discusses a new retirement solution that combines the benefits of a lifetime income stream and a flexible investment account. As you know, we are always looking for ways to help you make informed decisions and achieve your goals. That’s why we have been talking to some of the best fund […]

Fund Manager Friday – Episode 1 – Generation Life

Michael Jaeger explains how Generation Life is transforming the investment industry with a simple and effective product. As you know, we are always looking for ways to help you make informed decisions and achieve your goals. That’s why we have been talking to some of the best fund managers and product providers in the industry […]

More4Life supports SurfAid

Last Friday 11 November, More4Life took part in the annual SurfAid Cup at Manly beach. We raised just under $3,000 out of a combined total of $95,000. I commandeered the best surfers for our team – my son Jack, his friends Winter Vincent and Ethan Dodson, and our pro surfer Christo Hall. We came fourth […]

Look After Yourself

There have been countless articles written about how much is sufficient to retire on. The table below is thanks to Super Consumers Australia and illustrates what a low, medium, and high spender will spend, and the corresponding lump sum that is needed to enable them to draw this type of income in retirement. In our […]

The Wealth Conundrum

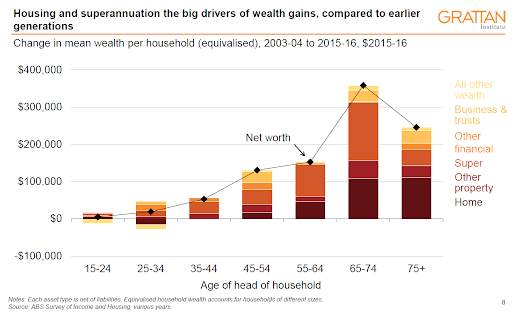

The baby boomers are retiring far wealthier than previous generations. The average retiring household has over $1 million in wealth, with much outside super (Grattan Institute). Peter Gell, Master Tax Lawyer, has noticed a sizeable difference in estates over the past 5-7 years. He only sees the Estates getting even larger as property values increase [...]

Findings of the Royal Commission and Client’s reply

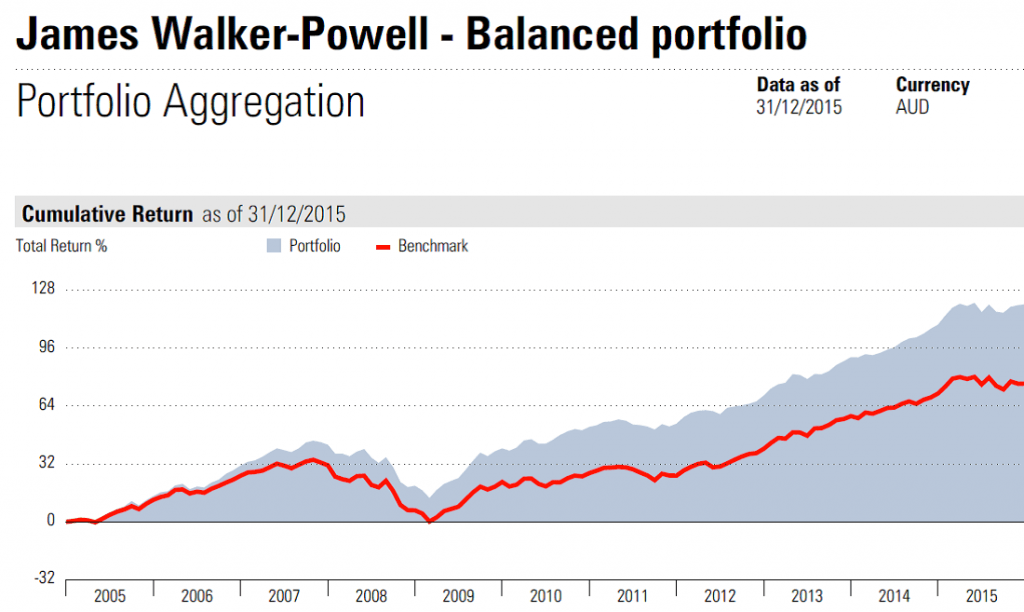

This is what James Walker-Powell sent to all MLFS clients… Findings of the Royal Commission The findings and subsequent media battering of the financial planning industry is both disturbing, uncomfortable and unfortunately predictable. While there have always been campaigns by certain sectors of the media to discredit financial advisers, what is different now is the […]

My day as an expert witness…

Mid-2017 I was approached by a Solicitor-client of mine to prepare an expert witness report for an intellectually disabled client of his. The facts of the case were as follows; The client was a 57-year-old man with an intellectual disability His wife was age 70, and she also has an intellectual disability The client’s father […]

Generational Inequity…August 2016

The government will spend around $154 billion on social security and welfare payments – around 35.4 per cent of total Government spending – in the 2015/16 financial year. Of this, more than $60 billion, or 39.4 per cent, will be spent on assisting

Bitter Battle of Conscience…March 2016

It felt as if, as a Mother, I was facing the toughest decision of my life, harsher than the decision to move our family 11 058 kilometres across the Indian Ocean. Should I return to work full-time and satisfy my disposition for intellectual stimulation,

Your More4Life Portfolio…January 2016

Between 31 December 2015 and 15 January 2016 the Australian share market lost 7.6% (as measured by the ASX 200 index), while global markets fell 8.4% in local currency terms and 3.1% in Australian dollar terms (as measured by the MSCI ex Australia Index).

New Year’s Eve Lessons Learned…January 2016

Around mid-November last year (2015), I was doing what I’d been doing every Monday evening for years…wrestling at Langs Mixed Martial Arts Gym. Halfway through the class, I felt a slight back pain, and as a precaution decided to call it a night. After trying

More4Life – Its Beginning, Its History…January 2016

When I was a young boy, a friend’s father revealed to me a secret about money which has stayed with me until now: “It’s not about how much money you earn but what you do with it that matters.” It was a startling revelation to a kid who had grown up